| • | approving the scheduling of regular and, where feasible, special meetings of the Board to ensure that there is sufficient time for discussion of all agenda items; consulting with the Chairman to establish, and approve, the agenda and scope of materials for each Board meeting;

presiding at all executive sessions of the independent directors and Board meetings at which the Chairman is not present;

| | • | consulting with the Chairman to establish, and approve, the agenda and scope of materials for each Board meeting; | | • | presiding at all executive sessions of the independent directors and Board meetings at which the Chairman is not present; | | • | serving as a liaison between the Chairman and the independent directors and coordinating the activities of such directors; | | • | coordinating the agenda for, and moderating sessions of, the Board’s independent directors; and | | • | facilitating communications among the other members of the Board. |

NOBLE ENERGY•2020 PROXY STATEMENT 2

serving as a liaison between the Chairman and the independent directors and coordinating the activities of such directors;

coordinating the agenda for, and moderating sessions of the Board’s independent directors; and

facilitating communications among the other members of the Board.

—BOARD AND COMMITTEES In 2017,2019, our Board held 1814 meetings, and its committees held 1921 meetings. Each director attended 75% or more of the aggregate of all meetings of the Board and the committees on which the director served during 2017, other than Ms. Ladhani who attended 60% of the meetings.(1)

2019.Our Board has the following four standing committees, each with a written charter adopted by the Board and available on our website: Website:| • | Audit Committee; Corporate Governance and Nominating (“Governance”) Committee;

Compensation, Benefits and Stock Option (“Compensation”) Committee; and

Environment, Health and Safety (“EH&S”) Committee.

(1) As a new member of our Board in the fourth quarter of 2017, the Company and Ms. Ladhani experienced scheduling conflicts with respect to certain meetings.

Primary Responsibilities

The primary responsibilities of each committee are summarized below. For more detail, see the committee charters on our website at www.nblenergy.com, under the heading “Corporate Governance.”

| | • | | Compensation, Benefits and Stock Option (“Compensation”) Committee; | Committee• | | Key Oversight ResponsibilitiesCorporate Governance and Nominating (“Governance”) Committee; and | Audit• | | •

Integrity of the Company’s financial statements•

DisclosureSafety, Sustainability and internal controls•

Compliance with legal and regulatory requirements•

Administration of the Company’s Code of Conduct•

Independent auditor qualifications•

Internal audit functions

| Governance | | •

Corporate governance, including the Corporate Governance Guidelines•

Director recruitment, retention and development•

Board committee structure and membership•

Annual Board and committee self-evaluation•

Corporate political activities

| Compensation | | •

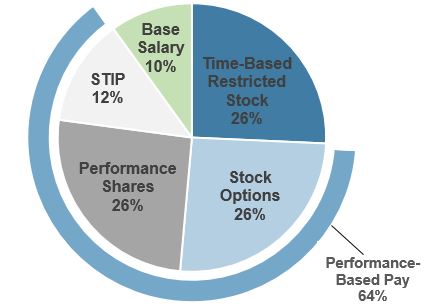

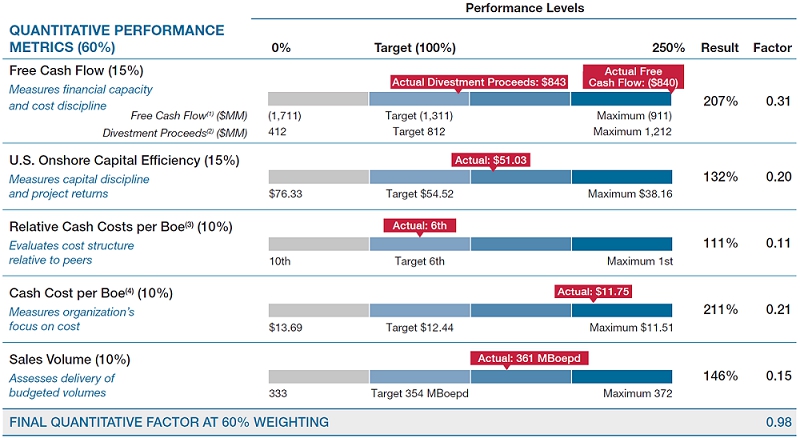

CEO and other executive officer compensation structure and amount•

Performance evaluations for the CEO and other executive officers•

Design and function of incentive compensation programs, including STIP and equity-based plans•

Executive officer stock ownership guidelines•

Compensation Discussion & Analysis | EH&S | | •

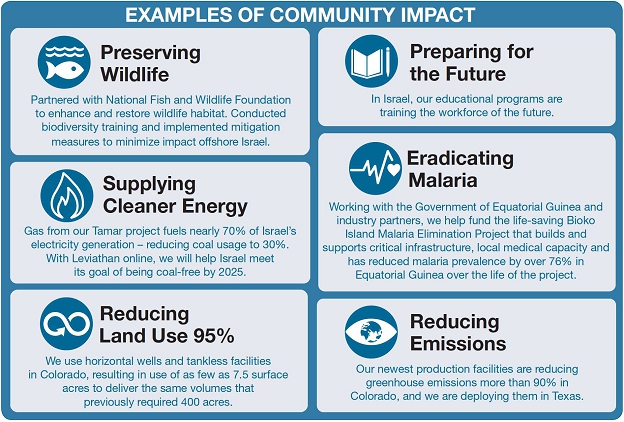

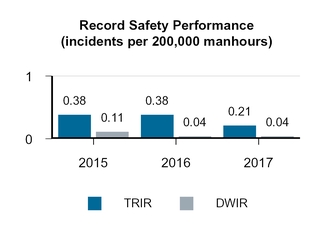

EH&S policies and management systems•

Compliance with EH&S legal and regulatory requirements•

Corporate social responsibility and climate policy

Responsibility (“SSCR”) Committee. |

The following table lists the current members of each committee and the number of meetings held during 2017. | | | | | | | | | | | Name | | Audit(1) | | Compensation | | Governance | | EH&S | | Jeffrey L. Berenson* | | | | | | | | | | Michael A. Cawley* | | | | | | Chair | | | | Edward F. Cox* | |

| | | | | |

| James E. Craddock*(2) | | | | | | | | Chair | | Thomas J. Edelman* | | | | | | | | | | Kirby L. Hedrick* | | | | | | | | | | Holli C. Ladhani | | | | | | | | | | David L. Stover | | | | | | | | | | Scott D. Urban* | | | | Chair | | | | | | William T. Van Kleef* | | Chair | | | | | | | | Molly K. Williamson* | | | | | | | | | | Number of Meetings | | 5 | | 6 | | 5 | | 3 |

*Independent Directors

2019.| Name | Audit(1) | Compensation | Governance | SSCR | | Jeffrey L. Berenson* | | Chair |  | | | Michael A. Cawley*(2) |  | |  | | | James E. Craddock*(3) | |  |  | Chair | | Barbara J. Duganier* |  | |  | | | Thomas J. Edelman* | |  |  |  | | Holli C. Ladhani* | | |  |  | | David L. Stover | | | |  | | Scott D. Urban* | |  | Chair |  | | William T. Van Kleef* | Chair | |  | | | Martha B. Wyrsch* |  | |  | | | Number of Meetings | 6 | 6 | 5 | 4 |

| * | Independent Director | | (1) | Each member of our Audit Committee has been determined by the Board to be financially literate and meets the additional criteria for independence of audit committee members as set forth in Securities and Exchange Commission (“SEC”) ruleRule 10A-3(b)(1). Mr. Van Kleef has been determined by the Board to be an audit committee financial expert. |

| expert as that term is defined in Item 407(d)(5) of Regulation S-K. | | (2) | As of the date of the 2020 Annual Meeting of Shareholders, Mr. Cawley, as the former lead independent director, will have served his additional year after the mandatory retirement age of 72; as a result, after 25 years of experience with our Board, he will not stand for re-election at the Annual Meeting. | | (3) | Mr. Craddock was the CEO of Rosetta Resources Inc. (“Rosetta”) prior to its merger with the Company on July 20, 2015. Our Board has reviewed the applicable rules and regulations of the SEC and the standards and guidance of the New York Stock ExchangeNasdaq Global Select Market (“NYSE”Nasdaq”) and concluded that Mr. Craddock is independent. As a prior employee of the acquired company, Rosetta, an entity previously unaffiliated with the Company, the NYSENasdaq allows a determination of independence since the termination of his employment with Rosetta occurred concurrently with the closing of the merger. |

NOBLE ENERGY• 2020 PROXY STATEMENT 3 Primary Responsibilities The primary responsibilities of each committee are summarized below. For more detail, see the committee charters on our Website at www.nblenergy.com, under the heading “Corporate Governance.” | Committee | Key Oversight Responsibilities | | Audit | • | Integrity of the Company’s financial statements | | • | Disclosure and internal controls | | • | Compliance with legal and regulatory requirements | | • | Administration of the Company’s Code of Conduct | | • | Independent auditor qualifications | | • | Internal audit functions | | • | Risk management | | Compensation | • | CEO and other executive officer compensation structure and amount | | • | Performance evaluations for the CEO and other executive officers | | • | Design and function of incentive compensation programs, including STIP and equity-based plans | | • | Executive officer stock ownership guidelines | | • | Compensation Discussion & Analysis | | Governance | • | Corporate governance, including the Corporate Governance Guidelines | | • | Director recruitment, retention and development | | • | Board committee structure and membership | | • | Annual Board and committee self-evaluation | | • | Corporate political activities | | SSCR | • | Monitor environmental, climate, health, safety, social, public policy and corporate responsibility trends, issues and concerns | | • | Evaluate corporate SSCR policies, management systems, investments, strategies and initiatives | | • | Compliance with SSCR legal and regulatory requirements |

Compensation Committee Interlocks and Insider Participation

During fiscal year 2017,2019, Messrs. Berenson, Cox, Craddock, Edelman Hedrick,and Urban and Ms. Williamson served as members of the Compensation Committee, with Messrs. Cox and Hedrick exiting and Mr. Urban joining the committee on April 25, 2017.Committee. None of the Compensation Committee members was an officer or employee of the Company or former officer of the Company or had any business relationship or conducted any business with the Company other than as described in the Related Person Transactions disclosure in this Proxy Statement. During fiscal year 2017,2019, none of our executive officers served as a director or member of the Compensation Committee (or other committee of the board performing equivalent functions) of another entity where an executive officer of such entity served as a director of the Company or on our Compensation Committee. NOBLE ENERGY• 2020 PROXY STATEMENT 4

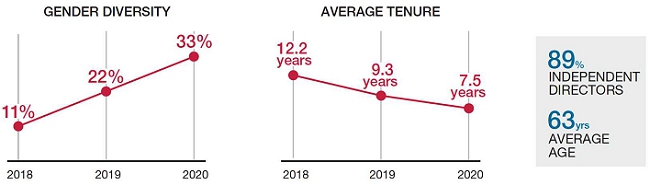

—BOARD DEVELOPMENT AND SUCCESSION PLANNING Our Board plays a key role in the oversight of the Company’s business.business, strategy and risk management. We are committed to ensuring that it representsincluding a diversitydiverse range of qualifications, attributes, skills, perspectives and experience necessary for our future.experiences in order to deliver sustainable value. We recognize that ourengage with shareholders are interested in board tenure and diversity —incorporate feedback regarding areas of consideration in our Board succession planning.planning such as tenure and diversity. We know that the most successful boards, like their executive management team counterparts,work to have the collective chemistry, strength, agility and strategic perspectiveperspectives to meet the challenges of the fast-moving global business environment within which we operate. In our view, our current Board possesses these traits and we have taken a number of steps to position itis well-positioned for our future. | Key areas of focus | Actions taken | 1. Shareholder

Engagement | In 2019, we requested engagement with our top 30 shareholders, representing over 80% of our outstanding stock. We also solicited feedback from representatives of the proxy advisory firms, Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co. (“Glass Lewis”). These discussions provided valuable insights, validating our practices in some areas and identifying areas for improvement in others. Overall, we received positive feedback on our enhanced climate disclosures, progress on Board refreshment, and disclosures on compensation and Board composition, and we received suggestions on succession planning and ESG performance. | 2. Board

Refreshment | We welcomed Martha Wyrsch to the Board in December of 2019, bringing extensive executive management experience and diverse industry perspectives and knowledge. In addition, the Board engaged in an evaluation process to identify the skills needed to enhance the strategic direction of the Board, and the Company works with an independent director search firm to help identify prospective director candidates. The Governance Committee continuously evaluates the skill-sets needed to maximize Board effectiveness and support the strategic direction of the Company. In connection with this objective, the Board has undergone significant refreshment, resulting in a lower average tenure and age and greater diversity of experiences (see “Board Refreshment” below). | 3. Board

Self-Evaluation | We continued our practice of conducting our Board self-evaluation process through a participative discussion conducted by an independent third-party law firm. This discussion has included a focus on the evolution of the Board, the Company’s strategic plan and alignment between the Board and management. | 4. Director

Retirement Age | In early 2017, we reduced the retirement age to 72. We believe that this facilitates an effective succession process that balances experience and continuity with periodic infusion of new directors and perspectives. In February 2019, we further amended our By-Laws to allow for the lead independent director to remain eligible for election for one additional year to provide for an orderly transition of duties to the newly-appointed lead independent. As of the date of the 2020 Annual Meeting of Shareholders, Mr. Cawley, as the former lead independent director, will have served his additional year after the mandatory retirement age of 72; as a result, after 25 years of experience with our Board, he will not stand for re-election at the Annual Meeting. | 5. Director

Compensation | We have revisited our director compensation program to ensure its alignment with our compensation peer group. We reduced total director compensation by eliminating additional retainers paid for committee service. We believe that this change is consistent with overall peer company practices and in the best interest of our shareholders. |

Board Refreshment The following highlights key information for the director nominees as of the applicable Annual Meeting:

NOBLE ENERGY• 2020 PROXY STATEMENT 5

First, we have placed a greater emphasis on understanding governance trends, with our Governance Committee holding periodic discussions on the topic based on information provided by inside and outside experts.

Second, consistent with this emphasis, we have expanded our outreach as part of our shareholder engagement program. In 2017, we requested meetings with 32 shareholders, representing approximately 71% of our outstanding stock. We also solicited feedback from representatives of the proxy advisory firms, Glass, Lewis & Co. (“Glass Lewis”) and Institutional Shareholder Services Inc. (“ISS”). These meetings were invaluable in providing validation of our practices in some areas, while identifying areas for improvement in others. In general, we received positive feedback on our continued efforts to enhance our public disclosures and our progress on Board refreshment. We also received suggestions on improving our efforts and disclosures on Board strategy, succession planning and climate change disclosure.

Third, we continue to focus on the importance of Board refreshment and, on April 25, 2017, the Board rotated committee members between the Compensation and Audit Committees to provide fresh perspectives on those committees. In addition, the Board underwent an evaluation process to identify the skills needed to enhance the strategic direction of the Board. The Company then engaged an independent director search firm to help identify prospective director candidates. In October 2017, the Board elected Ms. Holli C. Ladhani as a director. Her experience in executive leadership, together with her expertise in energy services and finance will be invaluable. Effective the date of the Annual Meeting of Shareholders, Mr. Hedrick, after 15 years of Board service, has decided not to stand for re-election at the 2018 Annual Meeting of Shareholders. The Governance Committee continues discussions to evaluate the skill-sets needed to maximize Board effectiveness and support the strategic direction of the Company.

Fourth, we have evolved our Board self-evaluation process to a more participative discussion conducted by an independent third-party interviewer. In the current environment, this discussion has included Board refreshment, communication with management and the Company’s competitive landscape.

Fifth, in early 2017, we amended our By-Laws to reduce the age at which a director would not stand for election from 75 to 72. We believe that this will facilitate a more orderly succession process that provides for the periodic infusion of new directors and the diversity of their perspectives. Effective the date of the 2018 Annual Meeting of Shareholders, Ms. Williamson will have reached mandatory retirement age of 72 and will not stand for re-election.

Finally, we have revisited our director compensation program to ensure its alignment with our compensation peer group, eliminating fees for regular meetings and continuing with reduced fees for specially called telephonic meetings. We increased our annual board member retainer, lead independent director retainer and chair retainers for three of our four committees. We believe that this change is consistent with overall peer company practices.

—OVERSIGHT OF RISK MANAGEMENT Our risk management program is overseen by our Board and its committees, with support from our management and external consultants. | | | | | Oversight of Risk Management | | | • | The Board oversees risk management.the Company’s identification and management of risk. | | | • | Board committees, which meet regularly and report back to the Board, play significant roles in carrying out the risk oversight function. | | | • | Our management is charged with managing risk through robust internal processes and controls. | | | • | External consultants provide independent perspectives on our risk management program and assist in the implementation of enhancements. | |

Our Board | • | addresses enterprise risk management as an agenda item for regular Board meetings, with our Chairman consulting with our Lead Independent Director to define the topic and scope of each discussion; | | • | maintains multiple processes in support of risk management, such as those by which our Board reviews and approves our capital budget and certain capital projects, hedging policy, new country entry, significant acquisitions and divestitures, equity and debt offerings and the delegation of authority to our management; and | | • | oversees sustainability, corporate and social responsibility and climate specific risk and opportunities, through our SSCR Committee that meets four times per year and reports regularly to the full Board. |

Our Management | • | maintains committees responsible for enterprise risk management, compliance and ethics, disclosures and addressing sustainability, corporate responsibility and climate related risk to our business; | Corporate Governance• | includes a dedicated Chief Compliance Officer; and | | • | regularly reports to our Board or its committees on our risk management practices. |

Our Board

includes enterprise risk management as an agenda item for regular Board meetings, with our Chairman consulting with our Lead Independent Director to define the topic and scope of each discussion;

maintains other processes in support of our risk management effort, such as those by which our Board reviews and approves our capital budget and certain capital projects, hedging policy, new country entry, significant acquisitions and divestitures, equity and debt offerings and the delegation of authority to our management; and

manages climate specific risk and opportunities, through our EH&S Committee that meets three times per year and reports regularly to the full Board.

Our Management

maintains committees responsible for enterprise risk management, compliance and ethics, disclosures and monitoring climate related risk to our business;

includes a dedicated Chief Compliance Officer; and

regularly reports to our Board or its committees on our risk management practices.

Our Independent External Consultants audit our financial statements, internal control over financial reporting and oil and gas reserves;

help evaluate the adequacy of our risk management program;

assist in the implementation of program enhancements; and

help prepare the risk disclosures in our public filings.

| • | audit our financial statements, internal control over financial reporting and oil and gas reserves; | | • | help evaluate the adequacy of our risk management program; | | • | assist in the implementation of program enhancements; and | | • | help prepare the risk disclosures in our public filings. |

Senior Leadership Succession Planning

A key responsibility of our CEO and Board in the area of risk management is ensuring thatmaintaining an effective process is in place to provide continuity of leadership over the long-term. Each year, a review ofour Board assesses incumbents and future senior leadership succession is conducted by our Board.succession. During this review, the CEO and the independent directors discuss candidates for senior leadership positions, succession timing for those positions and development plans for the highest-potential candidates. This process forms the basis for ongoing leadership assignments.

We have adopted a—CODES OF CONDUCT AND ETHICS Our Code of Conduct that applies to our directors, officers and employees and sets out our policypolicies regarding laws and business conduct, contains other policies relevant to business conduct and sets outprovides a process for reporting violations thereof. We have also adopted a Code of Ethics for Chief Executive and Senior Financial Officers, violations of which are to be reported to our Audit Committee. NOBLE ENERGY•2020 PROXY STATEMENT 6

In 2015, we formalized a shareholder engagement program that provides for management’s annual—INVESTOR ENGAGEMENT EFFORTS We have recurring active engagement with someour investors through participation in investor conferences, non-deal roadshows, and various in-office and telephone interactions throughout the year.

In 2019 we met or initiated contact with investors representing How we engaged with investors We attended 11 investor conferences, executed eight non-deal roadshows, and participated in 150 in-office meetings and phone conversations with potential or current investors We invited our top 30 investors to discuss agenda items for the annual meeting and any other topics they desire Our Board’s lead independent director participated in multiple investor calls in 2019 We regularly report our investors’ views on a variety of our key shareholderstopics to obtain feedback on our corporate governance practices. During 2017, we requested meetings with 32 shareholders, representing approximately 71% of our outstanding shares. We received feedback regarding board diversity, executive compensation metrics and climate change disclosure. Feedback was communicated to, and considered by, our Board of Directors Topics discussed with our investors Financial and operational performance of the Company continuesExecution on the Company’s strategy ESG and sustainability matters Executive compensation and other items specific to respond to shareholder feedback by working to improve its disclosures around governancethe Annual Meeting The Company’s initial Climate Resilience Report Board composition, independence and decisions in these areas.

| | Director Independence and Related Person Transactions |

diversity—DIRECTOR INDEPENDENCE AND RELATED PERSON TRANSACTIONS Director Independence

Our Governance Committee annually reviews the independence of our non-management directors and reports its findings to our Board. To assist in this review, our Board has adopted standards for director independence consistent with those of Nasdaq and the NYSE and SEC. These independence standards are set forth in our Corporate Governance Guidelines, which are available on our Website under the heading “Corporate Governance.”

In making independence determinations, our Board considers relevant facts and circumstances, including transactions, relationships and arrangements between each director or any member of the director’s immediate family and the Company, our subsidiaries and affiliates. Transactions considered by the Board during 20172019 through January 31, 20182020 included:

Company royalty program payments to Mr. Cox of $1,111,965 and Mr. Cawley of $10,238;

payments to the following portfolio companies of White Deer Energy (“White Deer”), of which Mr. Edelman is a managing partner: $389,764 to Patriot Well Solutions LLC (“Patriot”), $649,298 to Flogistix LP (“Flogistix”), and $209,506 to O-Tex Holdings Inc., which in November 2017 merged with and into C&J Energy Services (“CJ Energy”);

payments in the form of charitable contributions totaling $620,970 to the Wildlife Conservation Society, of which Mr. Edelman is a member of the board of trustees;

payments of approximately $15,312,997 to Oil States International, Inc., of which Mr. Van Kleef is a director; and

payments of $24,768,788 to Select Energy Services, Inc. (“Select Energy”) and affiliated companies of which Ms. Ladhani is the President and Chief Executive Officer.

| • | Company royalty program payments to Mr. Cawley of $13,305; | | • | payments of $3,371,524 to Flogistix LP (“Flogistix”), a portfolio company of White Deer Energy (“White Deer”), of which Mr. Edelman is a managing partner; | | • | payments in the form of charitable contributions totaling $1,921,363 to the Wildlife Conservation Society, of which Mr. Edelman is a member of the board of trustees; | | • | payments of approximate $12,507,697 to MRC Global (US) Inc., of which Ms. Duganier is a director; | | • | payments of approximately $22,786,101 to Oil States International, Inc., of which Mr. Van Kleef is a director; | | • | payments of approximately $3,937,574 to Pioneer Energy Services Corp. and affiliates, of which Mr. Urban is a director; and | | • | payments of $21,315,478 to Select Energy Services, Inc. (“Select Energy”) and affiliated companies, of which Ms. Ladhani is the President and Chief Executive Officer. |

Under the NYSE Listing Standards,Nasdaq listing standards, a director will not be considered independent if he/she is employed by a company that has, withinin the lastcurrent fiscal year or any one of the past three fiscal years, made or received payments from the Company, in excess of the greater of $1 million$200,000 or 2%5% of such Company’scompany’s revenues. Ms. Ladhani was elected as the President and Chief Executive Officer of Select Energy on November 1, 2017, pursuant to the merger of Select Energy with Rockwater Energy Solutions, Inc. (“Rockwater”). During 2017,2019, the Company made payments to Select Energy of approximately $24.8$20.4 million, which is in excess of 2%less than 5% of Select Energy’s 20172019 gross revenues. Effective October 26, 2017, the Board elected Ms. Ladhani as a director and has determined that she iswas not independent NOBLE ENERGY• 2020 PROXY STATEMENT 7 under the NYSE Listing Standards.Standards, which applied to the Company prior to December 30, 2019. As Select Energy has neither paid nor received payments from the Company in excess of 5% of Select Energy’s revenues in the current fiscal year or any of the past three fiscal years, the Board has determined that Ms. Ladhani meets the eligibility requirements for independence under Nasdaq listing standards. Ms. Ladhani is a valuable member of the Board and adds over 1718 years of experience in the broader energy industry, including CEO and CFO leadership, as well asand financial expertise to our Board. The Company expects that its payments to Select Energy will be less than 2% of Select Energy’s revenues prospectively, given the consolidated size of Select Energy and Rockwater. The Board anticipates being able to reconsider her independence in 2021 .

Under NYSE Listing Standards,Nasdaq listing standards, a director is not independent if he/she has been within the last three years an employee of the listed company. However, NYSENasdaq guidance clarifies that a former employee of an acquired company may still be considered independent if the employment relationship ended concurrent with a merger. Mr. Craddock’s employment with Rosetta ended concurrently with the Company’s merger with Rosetta on July 20, 2015. Mr. Craddock did not receive additional consideration subsequent to the merger, none of the Rosetta executives were retained by the Company, and the acquired assets represent a small portion of the Company’s total asset portfolio. Therefore, after review of the NYSErelevant Nasdaq guidance, as well as other relevant facts and circumstances, the CompanyBoard found, and continues to find, Mr. Craddock to be an independent director. Mr. Craddock brings valuable knowledge of our Delaware and Eagle Ford Shale assets, as well as CEO experience and a high level of financial literacy to our Board.

After reviewing these transactions, relationships and arrangements, on February 6, 20182020 our Board determined that no material relationship existed that would interfere with the ability of Messrs. Berenson, Cawley, Cox,

Craddock, Edelman, Hedrick, Urban and Van Kleef or Ms. WilliamsonMss. Duganier, Ladhani and Wyrsch to exercise independent judgment and that each is independent for Board membership purposes. Our Board has also determined that all members of our Audit, Compensation and Governance Committees are independent under the applicable NYSENasdaq independence standards and SEC rules.

Related Person Transactions

We review all relationships and transactions in which the Company and its directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. We have developed and implemented processes and controls to obtain information from our directors and executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether the Company or a related person has a direct or indirect material interest in the transaction.

As required under SEC rules, transactions that are determined to be directly or indirectly material to our Company or a related person are disclosed in our annual Proxy Statement. In addition, our Governance Committee or Board (if appropriate) reviews and approves or ratifies any related person transaction that is required to be disclosed. In the course of its review and approval or ratification of a disclosable related person transaction, consideration is given to:

the nature of the related person’s interest in the transaction;

the material terms of the transaction, including the amount and type of transaction;

the importance of the transaction to the related person;

the importance of the transaction to the Company;

whether the transaction would impair the judgment or ability of a director or executive officer to act in our best interest; and

any other matters deemed appropriate.

| • | the nature of the related person’s interest in the transaction; | | • | the material terms of the transaction, including the amount and type of transaction; | | • | the importance of the transaction to the related person; | | • | the importance of the transaction to the Company; | | • | whether the transaction would impair the judgment or ability of a director or executive officer to act in our best interest; and | | • | any other matters deemed appropriate. |

Any director who is a related person with respect to a transaction under review may not participate in the deliberations or vote respecting approval or ratification of the transaction, but that director may be counted in determining the presence of a quorum at the meeting where the transaction is considered.

Mr. Edelman is a managing partner of White Deer, a private equity firm that invests in the oil and gas industry. White Deer manages funds that own equity interests in certain companies with which the Company conducts business. During fiscal year 20172019 and through January 31, 20182020, the Company made payments totaling: $649,298totaling $3.4 million to Flogistix for the leasing of gas compression units. White Deer manages funds that own aan approximately 92.6% interest in Flogistix. Mr. Edelman has an estimated indirect pecuniary interest of 3.37%less than 5% in Flogistix;

$389,764 to Patriot for coil tubing services. White Deer manages funds that hold a 92.7% interest in Patriot. Mr. Edelman has an estimated indirect pecuniary interest of 3.37% in Patriot; and

$209,506 to CJ Energy for pumping services. White Deer manages funds that hold a 4.1% interest in CJ Energy. Mr. Edelman has an estimated indirect pecuniary interest of 0.25% in CJ Energy.

Flogistix.Ms. Ladhani is the President and CEO of Select Energy, a public company that provides its customers with efficient and environmentally conscious water and chemical solutions to service the full life cycle of the well. During fiscal year 20172019 and through January 31, 2018,2020, the Company made payments totaling $24.8$21.3 million to Select Energy and affiliated companies. In addition, a portfolio company of White Deer, Crescent Companies, LLC, merged into Rockwater in March 2017, that subsequently merged with Select Energy in November 2017. As a result, White Deer owns a 4.2%less than 2% interest ofin Select Energy, and Mr. Edelman has an indirect pecuniary interest of 0.26%less than 1% in Select Energy.

Energy through this investment by White Deer.Based upon the review and recommendations of our Governance Committee and our Board, we believe these transactions were in ourthe Company’s best interest and on terms no less favorable to us than we could have achieved with an unaffiliated party.

During fiscal year 20172019 and through January 31, 2018,2020, there were no other transactions in excess of $120,000 between our Company and a related person in which the related person had a direct or indirect material interest. NOBLE ENERGY• 2020 PROXY STATEMENT 8 Section 16(a) Beneficial Ownership Reporting Compliance

|  | DELINQUENT SECTION 16(a) REPORTS |

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Directors, executive officers and more than 10% shareholders are required by SEC regulations to provide us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies ofreports filed electronically with the reports furnished to usSEC during the most recent fiscal year and written representations that no other reports were required, all Section 16(a) filing requirements applicable to our directors, officers and more than 10% beneficial owners were complied with during the year ended December 31, 2017.

2019, other than a Form 3 for Mr. Elliot, which was amended to properly state holding information as of the date of his initial Form 3 filing.NOBLE ENERGY• 2020 PROXY STATEMENT 9

Ownership of Equity Securities of the Company

|  | OWNERSHIP OF EQUITY SECURITIES OF THE COMPANY |

—DIRECTORS AND NAMED EXECUTIVE OFFICERS The following table sets forth, as of February 23, 2018,24, 2020, the shares of our common stock and common units of NBLX beneficially owned by each director, each Named Executive Officer (“NEO”)NEO listed in the Summary Compensation Table included in this Proxy Statement, and all directors and executive officers as a group. | | | | | | | | | | | | | | Noble Energy, Inc. Common Stock Beneficially Owned(1) | Noble Midstream Partners LP(1) | | Name | Number of Shares (2) | Shares Underlying Stock Options (3) | Total | Percent of Class | Number of Common Units Beneficially Owned | Percentage of Common Units Beneficially Owned | | Director | | | | | | | | | Jeffrey L. Berenson | 58,277 |

|

| 55,262 |

| 113,539 |

| * | — | — | | Michael A. Cawley | 44,861 |

|

| 55,262 |

| 100,123 |

| * | — | — | | Edward F. Cox | 72,404 |

| (4) | 55,262 |

| 127,666 |

| * | — | — | | James E. Craddock | 101,913 |

|

| 39,147 |

| 141,060 |

| * | — | — | | Thomas J. Edelman | 3,359,352 |

| (5) | 55,262 |

| 3,414,614 |

| * | — | — | | Kirby L. Hedrick | 138,130 |

|

| 55,262 |

| 193,392 |

| * | — | — | | Holli C. Ladhani | 21,858 |

|

| — |

| 21,858 |

| * | — | — | | David L. Stover | 743,556 |

|

| 1,053,033 |

| 1,796,589 |

| * | 4,500 | * | | Scott D. Urban | 39,186 |

|

| 55,262 |

| 94,448 |

| * | — | — | | William T. Van Kleef | 106,304 |

|

| 55,262 |

| 161,566 |

| * | — | — | | Molly K. Williamson | 20,273 |

|

| 32,236 |

| 52,509 |

| * | — | — | | Named Executive Officer (excluding any director named above) | | | |

|

| | | | | Kenneth M. Fisher | 218,804 |

|

| 453,532 |

| 672,336 |

| * | 12,500 | * | | Gary W. Willingham | 200,005 |

| (6) | 233,682 |

| 433,687 |

| * | 10,000 | * | | Charles J. Rimer | 98,967 |

| (7) | 188,624 |

| 287,591 |

| * | — | — | | John K. Elliott | 102,602 |

|

| 141,113 |

| 243,715 |

| * | — | — | Susan M. Cunningham (10) | 108,124 |

|

| 415,926 |

| 524,050 |

| * | — | — | Arnold J. Johnson (10) | 103,754 |

| (8) | 231,840 |

| 335,594 |

| * | — | — | | All directors and executive officers as a group (22 persons) | 5,852,455 |

| (9) | 3,780,380 |

| 9,632,835 |

| 1.96% | 58,802 | * |

| | | Noble Energy, Inc.

Common Stock Beneficially Owned(1) | | Noble Midstream Partners LP(1) | | Name | | | Number of

Shares(2) | | | Shares

Underlying

Stock

Options(3) | | Total | | Percent of

Class | | Number of

Common Units

Beneficially Owned | | Percentage of

Common Units

Beneficially Owned | | Director | | | | | | | | | | | | | | | | Jeffrey L. Berenson | | | 77,325 | | | 42,140 | | 119,465 | | * | | — | | — | | Michael A. Cawley | | | 63,909 | | | 42,140 | | 106,049 | | * | | — | | — | | James E. Craddock | | | 103,461 | | | 29,391 | | 132,852 | | * | | — | | — | | Barbara J. Duganier | | | 25,899 | | | — | | 25,899 | | * | | — | | — | | Thomas J. Edelman | | | 3,338,400 | (4) | | 42,140 | | 3,380,540 | | * | | — | | — | | Holli C. Ladhani | | | 40,906 | | | — | | 40,906 | | * | | — | | — | | David L. Stover | | | 675,153 | | | 1,098,706 | | 1,773,859 | | * | | 4,500 | | * | | Scott D. Urban | | | 73,234 | | | 42,140 | | 115,374 | | * | | — | | — | | William T. Van Kleef | | | 125,352 | | | 42,140 | | 167,492 | | * | | — | | — | | Martha B. Wyrsch | | | 21,464 | | | — | | 21,464 | | * | | — | | — | | Named Executive Officer (excluding any director named above) | | | | | | | | | | | | | | | | Brent J. Smolik | | | 237,168 | | | 66,112 | | 303,280 | | * | | 7,500 | | * | | Kenneth M. Fisher | | | 170,864 | | | 439,256 | | 610,120 | | * | | 15,500 | | * | | Rachel G. Clingman | | | 67,664 | | | 25,767 | | 93,431 | | * | | — | | — | | John K. Elliott | | | 96,577 | | | 197,760 | | 294,337 | | * | | — | | — | | | | | | | | | | | | | | | | | | All directors and executive officers as a group (18 persons) | | | 5,315,639 | | | 2,341,915 | | 7,657,554 | | 1.58% | | 39,160 | | * |

| | | * | Represents less than one percent. |

| | | (1) | Unless otherwise indicated, all shares and units are directly held with sole voting and investment power. |

| | | (2) | Includes unvested restricted stock awards not currently vested, as follows: 6,47410,116 shares held by each of Messrs. Berenson, Cawley, Cox, Craddock, Edelman, Hedrick, Urban, Van Kleef, Ms. Duganier and Ms. Ladhani and 21,464 shares held by Ms. Williamson;Wyrsch; Mr. Stover — 403,102198,919 shares; Mr. Smolik — 223,426 shares; Mr. Fisher — 105,68357,743 shares; Mr. WillinghamMs. Clingman — 103,68262,774 shares; Mr. Rimer — 59,119 shares Mr. Elliott — 57,78137,900 shares; and other executive officers — 158,97598,416 shares. |

| | | (3) | Consists of shares not outstanding but subject to options that are currently exercisable or that will become exercisable on or before April 24, 2018. |

| 24,2020. | | (4) | Includes 28,33420,000 shares held by spouse. |

| | (5) | Includes 400,000spouse; 40,000 shares held under deferred compensation plans. |

| | (6) | Includes 11 shares indirectly held in a qualified 401(k) plan and 30,000by trusts for daughters; 40,000 shares held indirectly in an IRA.by descendants trust and 60,000 shares held by business ventures. |

| | (7) | Includes 5,122 shares indirectly held in a qualified 401(k) plan. |

| | (8) | Includes 5,783 shares indirectly held in a qualified 401(k) plan. |

| | (9) | Includes 13,877 aggregate number of shares indirectly held in a qualified 401(k) plan. |

| | (10) | Values for the restricted shares from the exit Form 4 filed upon Ms. Cunningham’s retirement and Mr. Johnson’s resignation, stock option information from Company records and common units in NBLX from the last Schedule 13D filed by the Company for holdings in NBLX. |

NOBLE ENERGY• 2020 PROXY STATEMENT 10

—SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS The following table sets forth, as of February 23, 2018,March 2, 2020, information about the number of shares held by persons we know to be the beneficial owners of more than 5% of our issued and outstanding common stock. | | | | | | Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percent of Class | Capital World Investors 333 South Hope Street Los Angeles, CA 90071 | 55,773,221 |

| (1) | 11.3% | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 51,019,310 |

| (2) | 10.4% | Capital Research Global Investors 333 South Hope Street Los Angeles, CA 90071 | 42,533,049 |

| (3) | 8.6% | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 33,188,644 |

| (4) | 6.7% | State Street Corporation

One Lincoln Street

Boston, MA 02111

| 26,278,348 |

| (5) | 5.3% |

Name and

Address of Beneficial Owner | | Number of Shares

of Common Stock

Beneficially Owned | | | Percent of Class | Capital International Investors

333 South Hope Street

Los Angeles, CA 90071 | | | 55,603,844 | (1) | | 11.6% | The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | | 54,324,077 | (2) | | 11.4% | Capital Research Global Investors

333 South Hope Street

Los Angeles, CA 90071 | | | 44,012,968 | (3) | | 9.2% | BlackRock, Inc.

55 East 52ndStreet

New York, NY 10055 | | | 32,929,847 | (4) | | 6.9% | State Street Corporation

One Lincoln Street

Boston, MA 02111 | | | 24,851,616 | (5) | | 5.2% |

| | | (1) | Based upon its Schedule 13G/A filed with the SEC on February 14, 20182020 with respect to its beneficial ownership of our common stock, Capital WorldInternational Investors has sole voting power with respect to 55,603,752 shares and sole dispositive power with respect to 55,773,22155,603,844 shares. Beneficial ownership of these shares is disclaimed. Capital WorldInternational Investors is a division of Capital Research and Management Company. |

| | | (2) | Based upon its Schedule 13G/A filed with the SEC on February 9, 201812, 2020 with respect to its beneficial ownership of our common stock, The Vanguard Group has sole voting power with respect to 666,516694,426 shares, shared voting power with respect to 115,239133,362 shares, sole dispositive power with respect to 50,253,17753,528,780 shares and shared dispositive power with respect to 766,133795,297 shares. |

| | | (3) | Based upon its Schedule 13G/A filed with the SEC on February 14, 20182020 with respect to its beneficial ownership of our common stock, Capital Research Global Investors has sole voting power with respect to 44,011,787 shares and sole dispositive power with respect to 42,533,04944,012,968 shares. Beneficial ownership of these shares is disclaimed. Capital Research Global Investors is a division of Capital Research and Management Company. |

| | | (4) | Based upon its Schedule 13G/A filed with the SEC on January 25, 2018February 5, 2020 with respect to its beneficial ownership of our common stock, BlackRock, Inc. has sole voting power with respect to 29,148,49628,530,665 shares and sole dispositive power with respect to 33,188,64432,929,847 shares. |

| | | (5) | Based upon its Schedule 13G filed with the SEC on February 14, 20182020 with respect to its beneficial ownership of our common stock, State Street Corporation has sole voting power with respect to 0 shares, shared voting power with respect to 26,278,34822,847,197 shares, sole dispositive power with respect to 0 shares and shared dispositive power with respect to 26,278,34824,819,965 shares. |

NOBLE ENERGY• 2020 PROXY STATEMENT 11

Shareholder Proposals and Other Matters

We have been notified by certain shareholders that they intend to present one proposal as set forth in this Proxy Statement at our 2018 Annual Meeting for action by the shareholders. Pursuant to Rule 14a-8(l)(1) of the Exchange Act, we will provide the address and number of shares of our common stock held by the proponents of that proposal promptly upon receipt of a written or oral request. Requests should be submitted to the Company Secretary.

| |  | SHAREHOLDER PROPOSALS AND OTHER MATTERS |

Shareholder proposals intended to be brought before our 20192021 Annual Meeting of Shareholders, which is currently scheduled to be held on April 27, 2021, as an agenda item in accordance with our By-Laws or to be included in our Proxy Statement relating to that meeting pursuant to Rule 14a-8 of the Exchange Act which is currently scheduled to be held on April 23, 2019, must be received by us at our office in Houston, Texas, addressed to our CompanyCorporate Secretary, no later than November 1, 2018.10, 2020. Shareholder proposals under our By-Laws may not be submitted for the 2021 Annual Meeting of Shareholders before October 11, 2020. |

NOBLE ENERGY• 2020 PROXY STATEMENT 12

| | Election of Directors (Proposal 1) | PROPOSAL 1 ELECTION OF DIRECTORS |

Election of Directors (Proposal 1)

Our Board is currently comprised of 11 directors. Our Board recommends voting for the nine director nominees as presented below, seveneight of whom are independent. The business experience of each nominee, as well as the qualifications that led our Board to select themeach for election to the Board, is discussed below. All directors are elected annually to serve until the next annual meeting and until their successors are elected and qualified.

—ELECTION PROCESS Our By-Laws provide that the number of directors shall be determined by the Board and that in an election where the number of nominees does not exceed the number of directors to be elected, each director must receive the majority of the votes cast with respect to that director.

Our Board will nominate candidates for election or re-election who agree to tender, promptly following the annual meeting, irrevocable resignations that will be effective upon (a) the failure to receive the required vote at the next annual meeting and (b) acceptance by the Board. In addition, our Board will fill director vacancies and new directorships only with candidates who agree to tender the same form of resignation promptly following their appointment to the Board.

If an incumbent director fails to receive the required vote for re-election, then, within 90 days following certification of the shareholder vote, our Governance Committee will act to determine whether to accept the director’s resignation and will submit its recommendation for consideration by our Board. The Board will promptly act on the resignation, taking into account the recommendation of the Governance Committee, and will publicly disclose its decision and rationale.

—DIRECTOR NOMINATIONS Our Governance Committee is responsible for identifying and evaluating nominees for director and for recommending to our Board a slate of nominees for election at each Annual Meeting of Shareholders. Nominees may be suggested by directors, members of management, shareholders or, in some cases, by a third-party search firm.

Shareholders who wish the Governance Committee to consider their recommendations for nominees for the position of director should submit a recommendation in writing to the Governance Committee, in care of the CompanyCorporate Secretary, between 120 and 150 days before the anniversary date of the mailing of the previous year’s proxy materials. Shareholder nominees for directors to be submitted for inclusion in our 20192021 Proxy Statement must be received by us after October 11, 2020 and by November 1, 2018.10, 2020. Our Corporate Governance Guidelines specify the processes for evaluating nominees for director and the requirements for a shareholder recommendation for a director nominee.

In addition, our By-Laws permit certain qualifying shareholders to include director nominees in our Proxy Statement. This proxy access mechanism allows a shareholder or group of up to 25 shareholders owning at least 3% of the Company’s outstanding common stock continuously for at least three years to submit their own candidate for election to our Board. These nominees may not constitute more than 25% of our Board at any time. Proxy access nominations must be delivered to the Company between 120 and 150 days before the anniversary date of the mailing of the previous year’s proxy materials and satisfy certain other criteria specified in our By-Laws. For inclusion in our 20192021 Proxy Statement, proxy access nominations must be received by us no later than November 1, 2018. NOBLE ENERGY• 2020 PROXY STATEMENT 13

—DIRECTOR QUALIFICATIONS Our Governance Committee believes that the minimum qualifications for serving as a director are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to our Board’s oversight of our business and affairs and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. Nominees for director shall be those people | | | Election of Directors (Proposal 1) |

who, after taking into account their skills, expertise, integrity, diversity, character, judgment, age, independence, corporate experience, length of service, potential conflicts of interest and commitments (including, among other things, service on the boards or comparable governing bodies of other public or private companies, charities, civic bodies or similar organizations) and other diverse attributes and qualities, are believed to enhance our Board’s ability to manage and direct, in an effective manner, our business and affairs, including, when applicable, to enhance the ability of the committees of our Board to fulfill their duties and to satisfy any independence requirements imposed by law, regulation or listing standards of the NYSE.

Nasdaq.In general, nominees for director should have an understanding of the workings of large business organizations such as ours and senior level executive experience, as well as the ability to make independent, analytical judgments, the ability to communicate effectively and the ability and willingness to devote the time and effort to be an effective and contributing member of our Board. In addition, our Governance Committee will examine a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest, and independence from management and our Company. It will also seek to have our Board represent a diversity of background, experience gender and race.other diverse attributes. Our Governance Committee annually reviews its long-term plan for Board composition, giving consideration to the foregoing factors. The above criteria and guidelines, together with the section of the Company’s Corporate Governance Guidelines entitled “Director Qualification Standards,” constitute the policy of the Governance Committee regarding the recommendation of new nominees or the re-election of directors to the Company’s Board of Directors or its committees. | | 2018 Nominees for Director |

—2020 NOMINEES FOR DIRECTOR Upon recommendation of the Governance Committee, our Board has nominated Jeffrey L. Berenson, Michael A. Cawley, Edward F. Cox, James E. Craddock, Barbara J. Duganier, Thomas J. Edelman, Holli C. Ladhani, David L. Stover, Scott D. Urban, and William T. Van Kleef and Martha B. Wyrsch for election as director.

Each of the director nominees currently serves on our Board and was elected by the shareholders at our 20172019 Annual Meeting of Shareholders, with the exception of Holli C. Ladhani,Martha B. Wyrsch, who was electedappointed on October 24, 2017December 11, 2019 by our Board. If elected, each nominee will hold office until the 20192021 Annual Meeting of Shareholders and until his or her successor is elected and qualified. We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should be unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by our Board, or our Board may reduce the number of directors.

Our Board believes that the combination of the various qualifications, skills, experiences and experiencesdiverse attributes of the 20182020 director nominees will contribute to an effective and well-functioning board. Our Board and the Governance Committee believe that, individually and as a whole, these director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to our Company’s management. | | Qualifications of 2018 Nominees for Director |

—QUALIFICATIONS OF 2020 NOMINEES FOR DIRECTOR In furtherance of the Director Qualifications discussed above, the following biographies highlight some categories of qualifications, attributes, skills and experience of each director nominee that led our Board to conclude that the director is qualified to serve.  | OUR BOARD RECOMMENDS THAT SHAREHOLDERSVOTE FORTHE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

NOBLE ENERGY• 2020 PROXY STATEMENT 14

Our Board recommends that shareholders vote FOR the election of each of the director nominees.

| JEFFREY L. BERENSON |

Age 69 Director

since: 2005 | | Skills and Qualifications • High level of financial literacy • Relevant Chief Executive Officer/President experience • Extensive knowledge of our industry and business • Risk assessment and management experience

Mr. Berenson is Chairman and Chief Executive Officer of Berenson Holdings LLC, a private investment banking firm in New York City that he co-founded in 1990. From 1978 until such co-founding, he was with Merrill Lynch’s Mergers and Acquisitions department, becoming head of that department in 1986 and then co-head of its Merchant Banking unit in 1988. Mr. Berenson previously served on the boards of directors of Epoch Holding Corporation and Patina Oil and Gas Corp. (“Patina”). Mr. Berenson also serves as a member of the Board of Trustees for the High Meadows Foundation. Mr. Berenson joined our Board upon completion of our merger with Patina in May 2005. |

| JAMES E. CRADDOCK |

Age 61 Director

since: 2015 | | Skills and Qualifications • High level of financial literacy • Relevant Chief Executive Officer/President experience • Extensive knowledge of our industry and business • Risk assessment and management experience

Mr. Craddock served as the Chairman and Chief Executive Officer of Rosetta from February 2013 through July 2015, when Rosetta merged with the Company. He joined Rosetta in April 2008 as Vice President, Drilling and Production Operations, and was named a Senior Vice President in January 2011. From April 2006 to March 2008, Mr. Craddock was Chief Operating Officer for BPI Energy, Inc. (“BPI”), an exploration and production start-up company focused on coal bed methane development. Mr. Craddock began his industry career with Superior Oil Company in 1981 and then held a broad range of technical, operational and strategic roles with Burlington Resources Inc. (“Burlington”) and its predecessor companies for more than 20 years. At Burlington, he held a series of positions of increasing responsibility, most recently as Chief Engineer. Mr. Craddock served as a director of Templar Energy LLC from 2017 through January 2019. Mr. Craddock has served as a member of the Board of Directors of Crescent Point Energy, Inc. and as a member of its Audit Committee and Reserves Committee since May 2019. Mr. Craddock also serves as a member of the Advisory Board of the Department of Engineering at Texas A&M University. He joined our Board upon completion of our merger with Rosetta in July 2015. |

| BARBARA J. DUGANIER |

Age 61 Director

since: 2018 | | Skills and Qualifications • High level of financial literacy • Extensive knowledge of cyber security • Risk assessment and management experience

Ms. Duganier was a managing director at Accenture from 2004 to 2013 where she held various leadership and management positions in Accenture’s outsourcing business, including as Global Chief Strategy Officer and as Global Growth and Offering Development Lead. Prior to Accenture, she served as an independent consultant to Duke Energy North America; a licensed certified public accountant and equity partner, at Arthur Andersen, including a role as Global Chief Financial Officer. Ms. Duganier was a director of the general partner of Buckeye Partners, L.P., chair of its audit committee and a member of the compensation committee until the sale of Buckeye Partners, L.P. in November 2019. Ms. Duganier is a director, governance committee member and audit committee chair of MRC Global Inc. Ms. Duganier also serves on the Board of Directors of West Monroe Partners, where she is the lead independent director and nominating and governance committee chair. Ms. Duganier serves as a member of the Board of Directors of John Carroll University. Previously, Ms. Duganier served as a director and member of the enterprise and risk oversight and compensation committees of HCC Insurance Holdings. Ms. Duganier is a National Association of Corporate Directors (“NACD”) Leadership Fellow, has received NACD’s certification in cybersecurity oversight and is the President of the NACD Texas Tricities. |

NOBLE ENERGY• 2020 PROXY STATEMENT 15 | THOMAS J. EDELMAN |

Age 69 Director Nominee Biographies

since: 2005 | | Skills and Qualifications • High level of financial literacy • Relevant Chief Executive Officer/President experience • Extensive knowledge of our industry and business • Risk assessment and management experience

Mr. Edelman is a managing partner of White Deer Energy, an energy private equity fund. He founded Patina and served as its Chairman and Chief Executive Officer from its formation in 1996 through its merger with the Company in 2005. Mr Edelman co-founded Snyder Oil Corporation and was its President from 1981 through 1997. He served as Chairman and CEO and later as Chairman of Range Resources Corporation from 1988 through 2003. He previously worked for First Boston Corporation and Lehman Brothers Kuhn Loeb Incorporated. Mr. Edelman serves on the boards of Corterra Energy, LLC, Midstream Texas LLC, Global Petro Storage Limited, Quanah Panhandle, LLC and Riverside Energy Company LLC. He is trustee of the Wildlife Conservation Society and The Frick Collection, serves on the Advisory Council of Princeton University’s Department of Politics, is an Emeritus member of the Investment Committee of The Hotchkiss School and is Chairman Emeritus of Lenox Hill Neighborhood House. He joined our Board upon completion of our merger with Patina in May 2005. |

| HOLLI C. LADHANI |

Age 49 Director

since: 2017 | | Skills and Qualifications • High level of financial literacy • Relevant Chief Executive Officer/President experience • Extensive knowledge of our industry and business • Risk assessment and management experience

Ms. Ladhani is President and Chief Executive Officer of Select Energy. Prior to its merger with Select Energy, Ms. Ladhani served as Chairman, President and Chief Executive Officer of Rockwater since February 2017 and Chief Executive Officer since June 2015. Ms. Ladhani held various positions at Rockwater since 2011, including Executive Vice President, Chemical Technologies and Chief Financial Officer. Prior to joining Rockwater, Ms. Ladhani served as Executive Vice President and Chief Financial Officer of Dynegy Inc. (“Dynegy”) since November 2005. She held various positions with Dynegy, including Senior Vice President, Treasurer and Controller. In November 2011, subsequent to Ms. Ladhani’s departure from Dynegy, two Dynegy subsidiaries of which Ms. Ladhani had previously been an officer filed for bankruptcy protection. Prior to joining Dynegy, Ms. Ladhani held various positions with PricewaterhouseCoopers LLP from 1992 to 2000. Ms. Ladhani serves on the board of Select Energy, on the board of trustees of Rice University, and as a board member of Junior Achievement of Southeast Texas. |

| DAVID L. STOVER |

Age 62 Director

since: 2014 | | Skills and Qualifications • High level of financial literacy • Broad international exposure • Extensive knowledge of our industry and business • Active in Community • Risk assessment and management experience

Mr. Stover has served as the Chief Executive Officer of Noble Energy since October 2014 and Chairman of the Board since April 2015. He served as President and Chief Executive Officer of Noble Energy from October 2014 to November 2018, served as President and Chief Operating Officer from May 2009 to October 2014, and served as Executive Vice President and Chief Operating Officer from August 2006 to April 2009. He joined the Company in 2002 and has served in various other senior leadership capacities, including Senior Vice President of North America and Business Development and Vice President of Business Development. Prior to joining the Company, he held various positions with BP America, Inc. (“BP”), Vastar Resources, Inc. (“Vastar”), and Atlantic Richfield Company (“ARCO”). Additionally, Mr. Stover is chairman of the board of directors and serves on the executive committee of Junior Achievement of Southeast Texas and serves on the executive committee of the American Petroleum Institute. |

NOBLE ENERGY• 2020 PROXY STATEMENT 16

| SCOTT D. URBAN | | | |

Age 66 Director

since: 2007 | | Jeffrey L. BerensonSkills and Qualifications • Relevant executive officer experience • Broad international exposure • Extensive knowledge of our industry and business • Risk assessment and management experience

Mr. Urban served in executive management positions at Amoco Corp. (“Amoco”) and its successor, BP, from 1977 to 2005. At the time of his retirement from BP in 2005, he was Group Vice President, Upstream for several profit centers including North America Gas, Alaska, Egypt and Middle East and, before that, Group Vice President, Upstream North Sea. He held various positions at Amoco including, at the time of its merger with BP, Group Vice President, Worldwide Exploration. Mr. Urban has been a partner in Edgewater Energy LLC, an investment consulting firm, since 2010, has served as a member of the board of directors of Pioneer Energy Services Corp. since 2008, and is the chairman of its Compensation Committee and a member of its Nominating and Governance Committee and Audit Committee. |

| WILLIAM T. VAN KLEEF |

Age 68 Director

since: 2005 | | Skills and Qualifications • High level of financial literacy • Relevant Chief Executive Officer/President experience • Extensive knowledge of our industry and business • Risk assessment and management experience

Mr. Van Kleef served in executive management positions at Tesoro Corporation (“Tesoro”) from 1993 to 2005, most recently as Tesoro’s Executive Vice President and Chief Operating Officer. During his tenure at Tesoro he held various positions, including President, Tesoro Refining and Marketing, and Executive Vice President and Chief Financial Officer. Before joining Tesoro, Mr. Van Kleef, a Certified Public Accountant, served in various financial and accounting positions with Damson Oil from 1982 to 1991, most recently as Senior Vice President and Chief Financial Officer. Mr. Van Kleef has also served as a member of the board of directors of Oil States International, Inc. since 2006 and is a member of the Board of Directors of SA Heals. |

| MARTHA B. WYRSCH |

Age 62 Director

since: 2019 | | Skills and Qualifications • Relevant executive officer experience • Broad international exposure • Extensive knowledge of our industry and business • Risk assessment and management experience

Ms. Wyrsch served as Executive Vice President and General Counsel of Sempra Energy, an energy infrastructure and services company with operations in the United States and internationally, from September 2013 until her retirement in March 2019. Prior to joining Sempra Energy, she served as President – North America of Vestas American Wind Technology, a wind turbine manufacturing and services company, from 2009 until 2012, where she had direct responsibility for the North American sales, construction, services and maintenance businesses. From 2007 until 2008, Ms. Wyrsch served as President and Chief Executive Officer of Spectra Energy Transmission, a natural gas transmission and storage business in the United States and Canada. From 1999 through 2007, she served in various roles of increasing responsibility with Duke Energy Corporation, including as President and Chief Executive Officer, Gas Transmission from 2005 until 2007. Ms. Wyrsch has served as a member of the board of directors of Spectris plc since 2012, and is a member of its Nomination Committee and Audit and Risk Committee. Ms. Wyrsch has served as a member of the board of First American Financial Corporation since 2018, and is a member of its Nominating and Corporate Governance Committee. Ms. Wyrsch has also served as a member of the board of Quanta Services, Inc. since 2019, and is a member of its Governance and Nominating Committee and Investment Committee. In addition, Ms. Wyrsch serves on the Board of Directors for the Cristo Rey Network and the Cristo Rey San Diego High School. |

NOBLE ENERGY• 2020 PROXY STATEMENT 17 | | Director since 2005 Age 67 | 2019 DIRECTOR COMPENSATION |

Mr. Berenson is Chairman and Chief Executive Officer of Berenson Holdings LLC, a private investment banking firm in New York City that he co-founded in 1990. From 1978 until such co-founding, he was with Merrill Lynch’s Mergers and Acquisitions department, becoming head of that department in 1986 and then co-head of its Merchant Banking unit in 1988. Mr. Berenson previously served on the boards of directors of Epoch Holding Corporation and Patina Oil and Gas Corp. (“Patina”) and joined our Board upon completion of our merger with Patina in May 2005.

Qualifications, Attributes, Skills and Experience:

High Level of Financial Literacy — has been in the investment banking business since 1978 and has a thorough understanding of the economic environment in which we operate.

Relevant Chief Executive Officer/President Experience — serves as Chairman and CEO of the private investment banking firm that he co-founded in 1990.

Extensive Knowledge of Our Industry and Business — has historical knowledge of our DJ Basin (Colorado) assets through his service as a director of Patina and since that time has had broad exposure to our business through over 12 years of service on our Board.

| | | | | | Michael A. Cawley | | Director since 1995 Age 70 |

Mr. Cawley has served as President and Manager of The Cawley Consulting Group, LLC since January 2012. He previously served as a director of Noble Corporation Plc (“Noble Corporation”) from 2010 to 2017. In 2014, Noble Corporation effected a spin-off of Paragon Offshore plc, which subsequently filed for bankruptcy protection on February 14, 2016. Mr. Cawley also previously served as President and Chief Executive Officer of The Samuel Roberts Noble Foundation, Inc. (the “Foundation”) from February 1992 until his retirement in January 2012, after serving as Executive Vice President of the Foundation since January 1991. Prior to 1991, Mr. Cawley was the President of Thompson and Cawley, a professional corporation, attorneys at law. Mr. Cawley served as a trustee of the Foundation from 1988 until his retirement. He has served on our Board since 1995 and has been our Lead Independent Director since 2001.

Qualifications, Attributes, Skills and Experience:

Relevant Chief Executive Officer/President Experience — served as President and CEO of the Foundation for nearly 20 years and as President of Thompson and Cawley, a professional corporation, attorneys at law.

Extensive Knowledge of Our Industry and Business — has historical knowledge of, and broad exposure to, our business through over 22 years of service on our Board.

Strong Governance Experience — worked as an attorney and law firm partner, and for over 17 years has served as our Lead Independent Director and chair of our Governance Committee.

| | | Director Nominee Biographies |

| | | | | | Edward F. Cox | | Director since 1984 Age 71 |

Mr. Cox is a retired partner of Patterson Belknap Webb & Tyler LLP, a law firm in New York City, having served as chair of the firm’s corporate department and as a member of its management committee. He currently serves as chair of the New York Republican State Committee (“NYRSC”) and as a member of the Republican National Committee. He was elected chair of the New York League of Conservation Voters Education Fund in 2004 and Secretary of the Economic Club of New York in 2013. He has served Presidents Nixon, Reagan and George H. W. Bush in the international arena, has been a member of the Council on Foreign Relations since 1993 and serves on the board of directors of the Foreign Policy Association of the American Ditchley Foundation. He has served on our Board since 1984.

Qualifications, Attributes, Skills and Experience:

Broad International Exposure — served three U.S. presidents in the international arena.

Extensive Knowledge of Our Industry and Business — has historical knowledge of, and broad exposure to, our business through over 33 years of service on our Board.

Governmental or Geopolitical Expertise — serves as chair of the NYRSC and has served in a presidential campaign leadership role.

Strong Governance Experience — worked as an attorney in private practice, chairing his firm’s corporate department.

| | | | | | James E. Craddock | | Director since 2015 Age 59 |

Mr. Craddock served as the Chairman and Chief Executive Officer of Rosetta from February 2013 through July 2015, when Rosetta merged with the Company. He joined Rosetta in April 2008 as Vice President, Drilling and Production Operations, and was named a Senior Vice President in January 2011. From April 2006 to March 2008, Mr. Craddock was Chief Operating Officer for BPI Energy, Inc. (“BPI”), an exploration and production start-up company focused on coal bed methane development. On February 3, 2009, BPI filed for bankruptcy protection. Mr. Craddock began his industry career with Superior Oil Company in 1981 and then held a broad range of technical, operational and strategic roles with Burlington Resources Inc. (“Burlington”) and its predecessor companies for more than 20 years. At Burlington, he held a series of positions of increasing responsibility, most recently as Chief Engineer. Mr. Craddock currently serves as a director of Templar Energy LLC. He joined our Board upon completion of our merger with Rosetta in July 2015.

Qualifications, Attributes, Skills and Experience:

High Level of Financial Literacy — has extensive experience in the financial aspects of our business through his leadership roles with several oil and gas companies.

Relevant Chief Executive Officer/President Experience — served as President and CEO of Rosetta from 2013 through its merger with the Company in 2015 and since that time has had exposure to our business through over two years of service on our Board.

Extensive Knowledge of Our Industry and Business — has historical knowledge of our Delaware Basin and Eagle Ford Shale assets through his service as CEO of Rosetta.

| | | Director Nominee Biographies |

| | | | | | Thomas J. Edelman | | Director since 2005 Age 67 |

Mr. Edelman is a managing partner of White Deer Energy, an energy private equity fund. He founded Patina and served as its Chairman and Chief Executive Officer from its formation in 1996 through its merger with the Company in 2005. Mr. Edelman co-founded Snyder Oil Corporation and was its President from 1981 through 1997. He served as Chairman and CEO and later as Chairman of Range Resources Corporation from 1988 through 2003. From 1980 to 1981 he was with the First Boston Corporation and from 1975 through 1980 with Lehman Brothers Kuhn Loeb Incorporated. Mr. Edelman serves on the boards of directors of Corterra Energy, LLC, Midstream Texas LLC, Global Petro Storage Limited, Quanah Panhandle, LLC and Riverside Energy Company LLC. He currently is trustee of the Wildlife Conservation Society and The Frick Collection, serves on the Advisory Council of Princeton University’s Department of Politics, is an Emeritus member of the Investment Committee of The Hotchkiss School and is Chairman Emeritus of Lenox Hill Neighborhood House. He joined our Board upon completion of our merger with Patina in May 2005.

Qualifications, Attributes, Skills and Experience:

High Level of Financial Literacy — has extensive experience with investment banking and private equity funds, as well as financial aspects of our business through leadership of large independent oil and gas companies.

Relevant Chief Executive Officer/President Experience — served as President and CEO of several independent oil and gas companies.

Extensive Knowledge of Our Industry and Business — has historical knowledge of our DJ Basin assets through his service as founder, Chairman and CEO of Patina and since that time has had broad exposure to our business through over 12 years of service on our Board.

| | | | | | Holli C. Ladhani | | Director since 2017 Age 47 |

Ms. Ladhani is President and Chief Executive Officer of Select Energy. Prior to its merger with Select Energy, Ms. Ladhani served as Chairman, President and Chief Executive Officer of Rockwater since February 2017 and Chief Executive Officer since June 2015. Ms. Ladhani held various positions at Rockwater since its formation in 2011 including Executive Vice President, Chemical Technologies and Chief Financial Officer. Prior to joining Rockwater, Ms. Ladhani served as Executive Vice President and Chief Financial Officer of Dynegy Inc. (“Dynegy”) since November 2005. She previously held various positions with Dynegy, including Senior Vice President, Treasurer and Controller, from 2000 to 2005. In November 2011, subsequent to Ms. Ladhani’s departure from Dynegy, two Dynegy subsidiaries of which Ms. Ladhani had previously been an officer filed for bankruptcy protection. Prior to joining Dynegy, Ms. Ladhani held various positions with PricewaterhouseCoopers LLP from 1992 to 2000. Ms. Ladhani serves on the boards of directors of Select Energy, Atlantic Power Corporation, a North American independent power producer, and is a board member of Junior Achievement of Southeast Texas. She joined our Board in October 2017.

Qualifications, Attributes, Skills and Experience:

High Level of Financial Literacy— has extensive exposure to the financial aspects of our business having served as CFO of Rockwater and Dynegy.

Relevant Chief Executive Officer/President Experience — serves as President and CEO of Select Energy and previously served as Chairman, President and CEO of Rockwater.

Extensive Knowledge of Our Industry and Business — has served in various positions within the broader energy industry since 2000.

| | | Director Nominee Biographies |

| | | | | | David L. Stover | | Director since 2014 Age 60 |

Mr. Stover has served as President and Chief Executive Officer of Noble Energy since October 2014, and Chairman of the Board since April 2015, as President and Chief Operating Officer since April 2009, and Executive Vice President and Chief Operating Officer since August 2006. He joined the Company in 2002 and has served in various other senior leadership capacities, including Senior Vice President of North America and Business Development and Vice President of Business Development. Prior to joining the Company, he held various positions with BP America, Inc. (“BP”), Vastar Resources, Inc. (“Vastar”), and Atlantic Richfield Company (“ARCO”). He joined our Board in April 2014.

Qualifications, Attributes, Skills and Experience:

High Level of Financial Literacy— has extensive exposure to the financial aspects of our business through his leadership roles in several oil and gas companies.

Broad International Exposure— led our exploration and production efforts in the Eastern Mediterranean and West Africa, as well as other international locations.

Extensive Knowledge of Our Industry and Business — has devoted a career to the oil and gas industry and overseen our operations since 2006.

Active in Community — serves in leadership roles in industry and community organizations in our Houston headquarters area.

| | | | | | Scott D. Urban | | Director since 2007 Age 64 |

Mr. Urban served in executive management positions at Amoco Corp. (“Amoco”) and its successor, BP, from 1977 to 2005. At the time of his retirement from BP in 2005, he was Group Vice President, Upstream for several profit centers including North America Gas, Alaska, Egypt and Middle East and, before that, Group Vice President, Upstream North Sea. He held various positions at Amoco including, at the time of its merger with BP, Group Vice President, Worldwide Exploration. Mr. Urban has been a partner in Edgewater Energy LLC, an investment consulting firm, since 2010 and has served as a member of the board of directors of Pioneer Energy Services Corporation since 2008. He joined our Board in October 2007.

Qualifications, Attributes, Skills and Experience:

Relevant Chief Executive Officer/President Experience — served as Group Vice President of a major international oil and gas company.

Broad International Exposure — led various onshore and offshore projects in Egypt, Middle East and North Sea, with an emphasis on exploration.

Extensive Knowledge of Our Industry and Business — has devoted a career to the oil and gas industry and has had broad exposure to our business through over 10 years of service on our Board.

| | | Director Nominee Biographies |

| | | | | | William T. Van Kleef | | Director since 2005 Age 66 |